Should I Refinance?

Deciding whether or not you should refinance depends on

your personal financial situation. If interest rates are lower

today than they were when you first took out your mortgage,

refinancing makes sense. Or, if you bought your home with

an adjustable rate mortgage (ARM) and are now afraid that

any movement in interest rates may cause your mortgage

cost to go up, you should consider a refinance.

Deciding whether or not you should refinance depends on

your personal financial situation. If interest rates are lower

today than they were when you first took out your mortgage,

refinancing makes sense. Or, if you bought your home with

an adjustable rate mortgage (ARM) and are now afraid that

any movement in interest rates may cause your mortgage

cost to go up, you should consider a refinance.

Refinancing a mortgage in order to pay off debt is a common strategy. Many homeowners use the financial disaster if done incorrectly

or without discipline. The homeowner needs to be aware of the risks and understand the pros and cons of consolidating debt with a

mortgage refinance.

Pros

There are some good points to paying off other debt by refinancing a mortgage. One is that usually a mortgage has a lower interest rate than other

debt. If you have a car loan or credit card debt, the interest rates could easily be twice that of your mortgage rate. By refinancing and consolidating

debt, you will see immediate monthly savings in your payments. Another pro is that you will eliminate multiple bills. It can be confusing trying to pay

several credit cards and car loans that are all due on a different day of the month. If you consolidate, you will need to pay only one bill every month,

which is your mortgage. One of the biggest pros is the tax benefit. Mortgage interest is tax deductible. So are certain fees involved with the closing,

like prepaid points. By consolidating your debt, you are taking mounds of debt that are not tax deductible and rolling them into a debt that is tax

deductible. You will see significant savings in your tax returns, especially if you have a large amount of debt.

or without discipline. The homeowner needs to be aware of the risks and understand the pros and cons of consolidating debt with a

mortgage refinance.

Pros

There are some good points to paying off other debt by refinancing a mortgage. One is that usually a mortgage has a lower interest rate than other

debt. If you have a car loan or credit card debt, the interest rates could easily be twice that of your mortgage rate. By refinancing and consolidating

debt, you will see immediate monthly savings in your payments. Another pro is that you will eliminate multiple bills. It can be confusing trying to pay

several credit cards and car loans that are all due on a different day of the month. If you consolidate, you will need to pay only one bill every month,

which is your mortgage. One of the biggest pros is the tax benefit. Mortgage interest is tax deductible. So are certain fees involved with the closing,

like prepaid points. By consolidating your debt, you are taking mounds of debt that are not tax deductible and rolling them into a debt that is tax

deductible. You will see significant savings in your tax returns, especially if you have a large amount of debt.

ARE YOU IN THE KNOW?

Programs At A Glance

Easy to read, quick reference, loan

program comparison chart to decide

which program is best for you.

Loan Application Checklist

Refer to this list while gathering your

financials when you apply for a

mortgage.

Application Disclosure FAQs

What is a TIL? APR? GFE?

How To Avoid Problems At Close

Quick tips to streamline your escrow

Common Types of Vesting

Ownership Rights to your property are

effected according to the manner you

choose to hold title.

Rules of Thumb

Dos and Donts

Closing Document Signing

Appointment Checklist

Familiarize yourself with the closing

process and avoid the stress.

Other Informational Links

By carefully considering the above factors and seeking our professional advice, you should be able to select the loan that financially suits your

intentions with the property.

More Loan Products and Programs

intentions with the property.

More Loan Products and Programs

Cons

There are cons to refinancing your mortgage in order to pay off debt. One is the

possibility of overspending. If you have large amounts of credit card debt because of

buying things you can't afford, then you will likely pay the cards off in the refinance

and charge them back up down the road. You will feel that you are no longer in debt,

when in reality, you just transferred the debt to another loan. So you must have

discipline in order to prevent this situation. Another downside to consolidating your

debt is that you are spreading the debt out over 30 years. A typical mortgage is 30

years long, and when you add that debt to your mortgage, you will be paying those

credit cards for 30 years to come. This means that in the end, you will have paid

more than if you paid each credit card on its own. And lastly, a big negative to

consolidating debt into a mortgage is the possibility of a foreclosure. If you increase

your loan amount, you may be unable to afford the new payment. You have now tied

your debt to your home, which could have a bad outcome in the future.

Real Estate Broker - CA Dept. of Real Estate License #01906363 | Malaga Funding, Inc.

NMLS# 872515 | NMLS Consumer Access: http://www.nmlsconsumeraccess.org

NMLS# 872515 | NMLS Consumer Access: http://www.nmlsconsumeraccess.org

| Andrea Dobrick | NMLS# 267223 Jose S. Gomez | NMLS# 262949 |

| RESIDENTIAL AND COMMERCIAL REAL ESTATE FINANCING |

| Info@MalagaFunding.com |

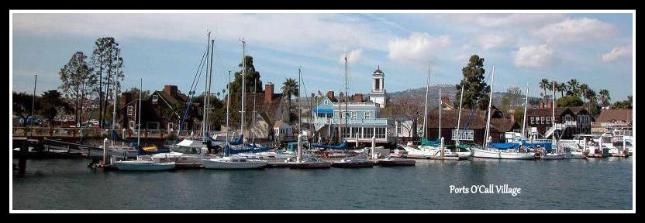

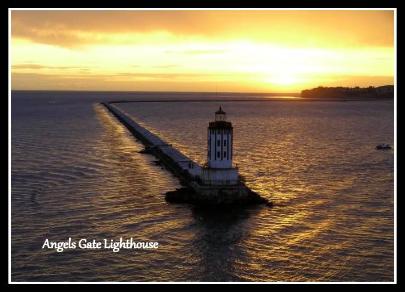

| 350 West 5th Street Suite 206 San Pedro, CA 90731 |

FAQs and How Tos

| 310.514.8799 |

Tightened Lending Requirements

It should be understood that as lenders have tightened their requirements and made credit more difficult to obtain,

borrowers who got caught up in some of the excesses of the credit crisis may have allowed their credit scores to fall.

Lenders will take a hard look at credit and if your credit falls below their acceptable range for lending, you will be

denied a loan. It is important that borrowers understand their financial situation and clear up any troubling issues that

they can in order to qualify for a refinanced loan at the lowest possible rate.

Compare the Old Loan Versus the New Loan

Working with a trained professional will help you avoid any pitfalls associated with refinancing your loan and allow you

to receive the best deal. You want to compare your current rate to the new rate and be sure there is a significant

reduction.

Also, you should review the loan amounts of the old and new loans. Many times, the costs of the loan are rolled into

the loan, significantly increasing the new loan amount.

It should be understood that as lenders have tightened their requirements and made credit more difficult to obtain,

borrowers who got caught up in some of the excesses of the credit crisis may have allowed their credit scores to fall.

Lenders will take a hard look at credit and if your credit falls below their acceptable range for lending, you will be

denied a loan. It is important that borrowers understand their financial situation and clear up any troubling issues that

they can in order to qualify for a refinanced loan at the lowest possible rate.

Compare the Old Loan Versus the New Loan

Working with a trained professional will help you avoid any pitfalls associated with refinancing your loan and allow you

to receive the best deal. You want to compare your current rate to the new rate and be sure there is a significant

reduction.

Also, you should review the loan amounts of the old and new loans. Many times, the costs of the loan are rolled into

the loan, significantly increasing the new loan amount.

Will Refinancing Improve Your Situation?

Making the decision to refinance a mortgage loan is based on how refinancing will improve your present loan situation.

This requires some careful consideration. A seasoned professional who can show you the difference refinancing can

make to your monthly costs is your best guide.

The “timing” for refinancing is created by understanding interest rates for mortgages and how they move. With little

movement in the sale of houses for awhile, the rates for mortgages have been fairly level or flat.

Making the decision to refinance a mortgage loan is based on how refinancing will improve your present loan situation.

This requires some careful consideration. A seasoned professional who can show you the difference refinancing can

make to your monthly costs is your best guide.

The “timing” for refinancing is created by understanding interest rates for mortgages and how they move. With little

movement in the sale of houses for awhile, the rates for mortgages have been fairly level or flat.

As the economy recovers from a near financial meltdown,

interest rates for new and existing homes will increase. As

the buying increases, homeowners should see higher

interest rates. The higher rates are a consequence of the

housing market demand. Before rates shoot up too far, a

homeowner looking to refinance should have determined if

they qualify.

The third important factor to consider is the payment terms

of the loan. For example, if you have a 30-year mortgage,

but have had it for ten years, you have a remaining 20-year

mortgage. If you refinance to a new 30-year mortgage, you

add interest to your mortgage over those ten years.